End-of-year tax planning you may not have considered

End-of-year tax planning you may not have considered

The end of another year is nearly here, and, in addition to gift buying and holiday cards, travel or meal planning, it’s a perfect time to start thinking about tax strategies. As a financial advisor at Altfest Personal Wealth Management, I’d like to share some recommended steps that are especially well-suited for physicians.

For decades our firm has worked with medical professionals, from new graduates to retired doctors, and through this we’ve developed an expertise we’re proud to share – one that could benefit you and your family.

First, it’s best to think of tax planning as a year-round activity, not just a mad scramble in early April. Once you adopt this mindset, think about how the following suggestions could fit with your financial situation and medical practice, now and throughout the new year.

Some tax-planning steps we recommend

If you haven’t heard of it, we’d like to introduce the concept of “tax-loss harvesting.” This is the act of selling investments at a loss and using those losses to offset any other gains you may have, as well as potentially using some of the losses to reduce ordinary income. You can use up to $3,000 of capital losses to offset ordinary income and reduce current-year taxes. If need be, you can even carry forward unused losses to future tax years, essentially creating a bank of losses that you can draw upon as needed.

Let’s look at an example to see how tax-loss harvesting works. Here we have two investments: Investment A and Investment B. Investment B has a $20,000 short-term capital gain, so it’s taxed at the ordinary rate. This individual ordinary rate is 35%, resulting in potential taxes of $7,000. Now, if we look at Investment B, it has a capital loss of $25,000. What we can do is use $20,000 of that loss to offset the $20,000 gain from Investment A, saving $7,000 in taxes. With the remaining $5,000, we can use $3,000 of that to offset ordinary income, further saving over a thousand dollars in taxes. With the remaining $2,000 in capital, we can then create that bank of losses mentioned earlier and use it to offset future capital gains and income.

You can see from this simple example that this is a very powerful tool – in our hypothetical, this taxpayer is able to save nearly $8,000 in taxes.

But as with most medical diagnoses and options for treatment plans, there can be some downsides to this tactic. One is making sure that you use your short-term versus long-term losses effectively. Long-term gains are taxed at preferential rate, with the top rate being 20%, while short-term gains are taxed at ordinary rates, with the highest being 37%. So, when possible, we want to make sure we don’t drag a short-term loss over to offset a long-term gain and therefore reduce the tax savings.

Another pitfall is managing wash-sale rules. Wash-sale rules mean that if you recognize a loss and 30 days before or after selling that position at a loss, you purchase the same position or a substantially identical one, part or all of your loss could be disallowed. It’s very important to monitor the transactions within your portfolio to avoid wash sales, something your financial advisor can help with.

|

Legislation That Could Affect Your Finances At Altfest, we like to keep our clients and prospects abreast of pending federal and state legislation that could impact their financial lives. Read more in the sidebars below about some important proposed law changes — and our suggestions for taking advantage of them. |

The third pitfall to be mindful of is never letting the tax tail wag the investment dog, meaning you should prioritize the health of your portfolio above all else. You never want to do tax-loss harvesting to the extent that you hurt your position in the market and suffer in terms of investment gains.

Managing capital gains distributions

Hand in hand with managing capital losses, it’s key to be mindful of how we treat gains, specifically capital gain distributions. These are investors’ pro rata share of any mutual fund’s or ETF’s net realized capital gains and income. Any gain associated with the sale of an underlying position in your mutual fund leads to investors getting their share of that gain but also can lead to taxation on it. If a fund manager is churning a lot of short-term gains, even if you’ve held that fund for a long time, you would still owe short-term capital gains tax. This is why it’s very important to evaluate the portfolio managers of mutual funds and ETFs to make sure they are tax-efficient.

The beauty of Roth conversions

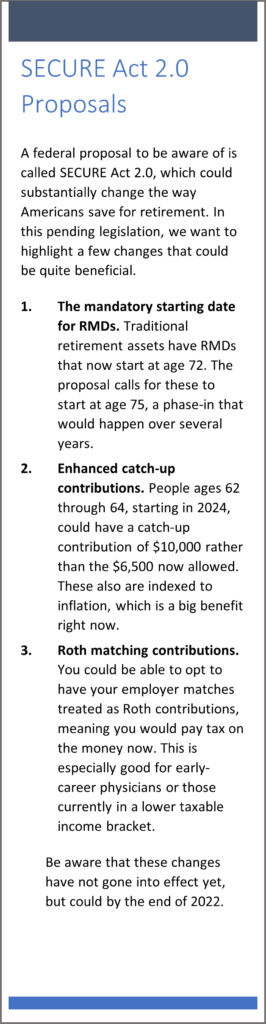

Another strategy we regularly urge for physician clients and prospective clients like you is taking advantage of Roth retirement account conversions. This involves moving assets from your traditional retirement account to a Roth account. In the year that you do so, as you probably know, you have to pay ordinary income tax on the converted funds. But by doing Roth conversions, you can actually end up saving taxes in the long run. (See the SECURE Act 2.0 sidebar below for potential changes to how you can build up a Roth account.)

Why would you want to do this? One reason is you can end up saving taxes later if you find yourself in a lower taxable-income year, maybe due to reduced compensation. If this year you are in a lower tax bracket than you have been in the past and anticipate being in in the future, by paying taxes through a Roth conversion now at that lower rate, you save on taxes in the future.

Roth assets also are great because they can grow tax-free until withdrawal. And because you pay taxes upfront, when you withdraw from those assets, you do not have to pay taxes again.

To add to the benefits of Roth assets, they do not have required minimum distributions (RMDs). Being that you paid taxes upfront, the IRS has no reason to force you to withdraw from this account to get tax revenue. So you can withdraw from it as needed and continue to benefit from that tax-free appreciation. This ultimately could be a great benefit for your beneficiaries, as well.

Reasons to hold off on a Roth conversion

However, before undertaking a Roth conversion you want to be sure you have the funds to pay the taxes due. You do not want to dip into your retirement account to pay the taxes on the converted funds as this may reduce the overall benefit of Roth conversions and even result in penalties for some.

Alternatively, you can perform a “backdoor Roth”. For many physicians, your modified adjusted gross income (MAGI) may be too high to be able to contribute to a Roth IRA directly. But there is no such MAGI limit for contributing to a traditional IRA. So, you can make non-deductible contributions to a traditional IRA and then immediately convert that to a Roth IRA. If done correctly, this will result in no additional tax being paid. Remember, it’s very important to adopt this strategy with a tax or financial professional, as if it’s not done correctly, it could result in taxes and penalties being owed.

In addition, think about what your future tax rates may be. Let’s say your plan is to retire and move to a state with lower income tax. That means right now may not be the time to do a Roth conversion; it may make more sense to do it once you move.

One more reason to consider whether Roth conversions are appropriate for you this year is whether you have charitable inclinations. If so, there may in fact be better ways to use traditional retirement assets for such purposes.

Charitable donations via retirement accounts

Charitable donations via retirement accounts

As mentioned, another smart tax strategy is to use traditional (non-Roth) retirement assets to fulfill your charitable inclinations with something called qualified charitable distributions (QCDs). In other words, using your traditional assets to donate directly to charity.

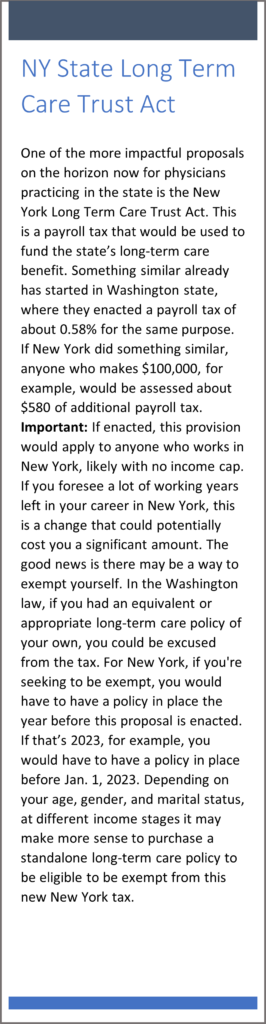

If you are age 70 1/2, you’re able to do this; however, many people wait until they are of RMD age, which is currently 72 (see the SECURE Act 2.0 sidebar for a possible increase in the RMD age), to use it. What’s special about this type of distribution is that it actually counts toward your RMD. But even better, it reduces your taxable income in that any amount donated does not have to be reported as taxable income. Let’s look at an example.

Think about an individual who has annual RMDs of $100,000. This person is married, and both spouses have the higher senior standard deduction, so their standard deduction is over $27,000. Because of their RMDs as well as their other income, their tax rate is the top 37%. Now these individuals are charitably inclined and usually like to give about $10,000 to charity every year. They also have other itemized deductions of around $15,000. Because of their higher standard deduction, if they were to give cash, they wouldn’t get any benefit from their donation because their itemized deduction is not greater than the standard deduction. But, instead, if they were to use QCDs and withdraw that $10,000 from their traditional IRA, $100,000 of taxable income that they would have to report then declines to $90,000 and they’re able to save over $3,000 in taxes.

There are other ways to give to charity in a tax-efficient way that we advocate, including donating appreciated securities.

Donor Advised Funds

Donor Advised Funds

You can supercharge this technique further by setting up a donor advised fund, or DAF. What is this? First, you set up and contribute to a DAF. Upon contributing, you get a tax deduction. Once the assets are in that fund, you can distribute to various charities as you see fit. For instance, if you expect to be in a higher tax bracket this year, you might transfer a lump sum to the DAF of 10 years’ worth of desired giving in 2022 but still actually donate that over the course of 10 years.

Max out your 401(k) or other employer-sponsored account

One of the easiest tax-saving strategies that you can leverage is maxing out your retirement savings each year. If you work at a private or a public hospital, you may have a 401(k) or 403(b) available to you. For 2022, you can put in $20,500 in employee contribution. If you’re over 50, you can contribute an additional $6,500. (See the SECURE Act 2.0 sidebar for a possible boost to this catch-up amount). If you’re making these contributions pretax, to a traditional retirement account, that amount would be excluded from taxable income this year. Additionally, if you’re a higher earner, your hospital may also offer a 457(b) plan to you, which is a deferred compensation plan. You’re able to contribute up to $20,500 to that on top of what you’re putting in your 401(k) or 403(b).

What’s effective about these accounts is they’re an easy way to shift some compensation out of your higher-earning years and move yourself into a lower tax bracket. There are no 10% early withdrawal penalties in these accounts, either. If you anticipate some higher expenses in the next couple of years, a 457(b) plan could be a great way to not only do tax saving, but also cash-flow planning.

Find Out More

We hope these ideas and updates can help you discover several ways to limit your tax exposure for 2022. Learn more about how Altfest’s advisors have helped countless physicians craft a more efficient tax strategy. If you have specific questions or concerns about you and your family’s situation, please book some time for a complimentary consultation.

Investment advisory services provided by Altfest Personal Wealth Management (“APWM”). All written content on this site is for information purposes only. Opinions expressed herein are solely those of APWM, unless otherwise specifically cited. Material presented is believed to be from reliable sources and no representations are made by our firm as to another parties’ informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation. All investing involves risk, including the potential for loss of principal. There is no guarantee that any investment plan or strategy will be successful.

Jessica Nelson, CPA, CFP

Prior to joining Altfest as a financial advisor, Jessica was a senior tax accountant within the financial services high net worth individual tax practice at Deloitte and Ernst and Young. Before that, Jessica was an independent auditor at Ernst and Young within the Banking and Capital Markets sector.

Jessica earned a MS in Financial Management and a BBA in Public Accounting from Pace University. Additionally, she is a CPA licensed in the State of New York and a CFP® professional.